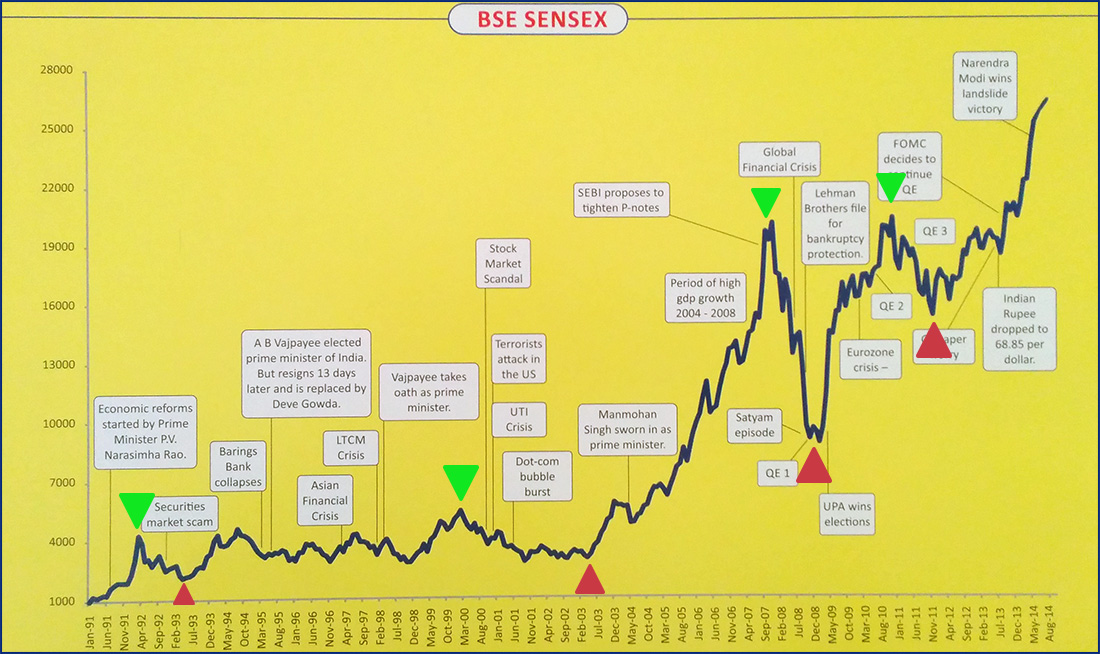

Market volatility is something which you cannot escape. It is more important to spend time in the market rather than timing the market.

If you want to give your investments the best chance of earning a return then it’s a good idea to cultivate the art of patience. The best returns tend to come from sticking with a long-term commitment to your investments.

The longer you’re prepared to stay invested, the greater the chance your investments will yield positive returns. During any long-term investment period, it is vital not to be distracted by the daily performance of individual investments. Instead stay focused on the bigger picture.

Success in the stock market is all about time and patience – it’s previously been noted that it should be more like watching paint dry.

But it’s understandable that when you put your money into the market, you will be tempted to check up on how your investments are performing on a regular basis and in our technology-driven age, you can monitor them 24/7.

Seeing investment prices fall, sometimes with alarming speed, can be enough to spook even the most experienced of investors. But remember that the reasons why you identified a particular fund or share as a sound investment in the first place should hopefully not have changed. The fall could just be down to market conditions as much as anything the individual company or fund manager has done, and in many cases, given enough time, investments should hopefully recover their value.

Developing the art of patience will help keep you focused on your goals. Whatever happens in the markets, in all probability your reasons for investing won’t have changed. For example, your aim may still be to cover education costs for your children, or save for retirement. A buy-and-hold investment strategy is likely to serve you best for these long-term goals.

If it was possible to know in advance when a market will lift from the bottom, or fall from the top, we’d be very rich.

Bear in mind too the benefits of so-called ‘rupee cost averaging’ during periods of market volatility. Essentially, if you are investing on a regular basis your contributions will buy more shares when prices are low and less when they are expensive. Over the long run this should help smooth out your returns, though there is no guarantee of this.

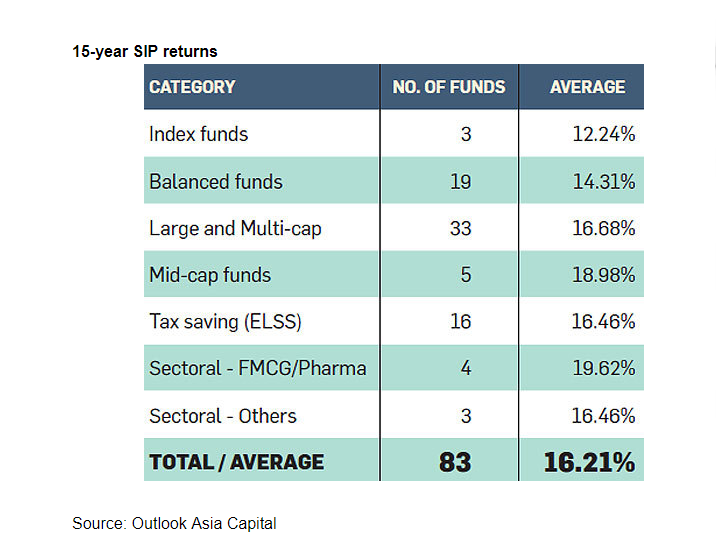

Take a look at the data that I have come across. If you have held your investments for a period of 15 years…..

Investment made: SIP of Rs.15,000 pm for 15 years = 15,000*12*15 = Rs.27,00,000

Average return : 16.21%

Corpus value : Rs.1,01,45,0714 (approximately Rs.1 crore).

If you continue the SIP for a further period of 15 years.

Investment made: SIP of Rs.15,000 pm for 30 years = 15,000*12*30 = Rs.54,00,000

Average Return: 16.21%

Corpus value: Rs.10,67,29,640.00 (Rs.10 crores plus)

This is the magic of compounding at work!

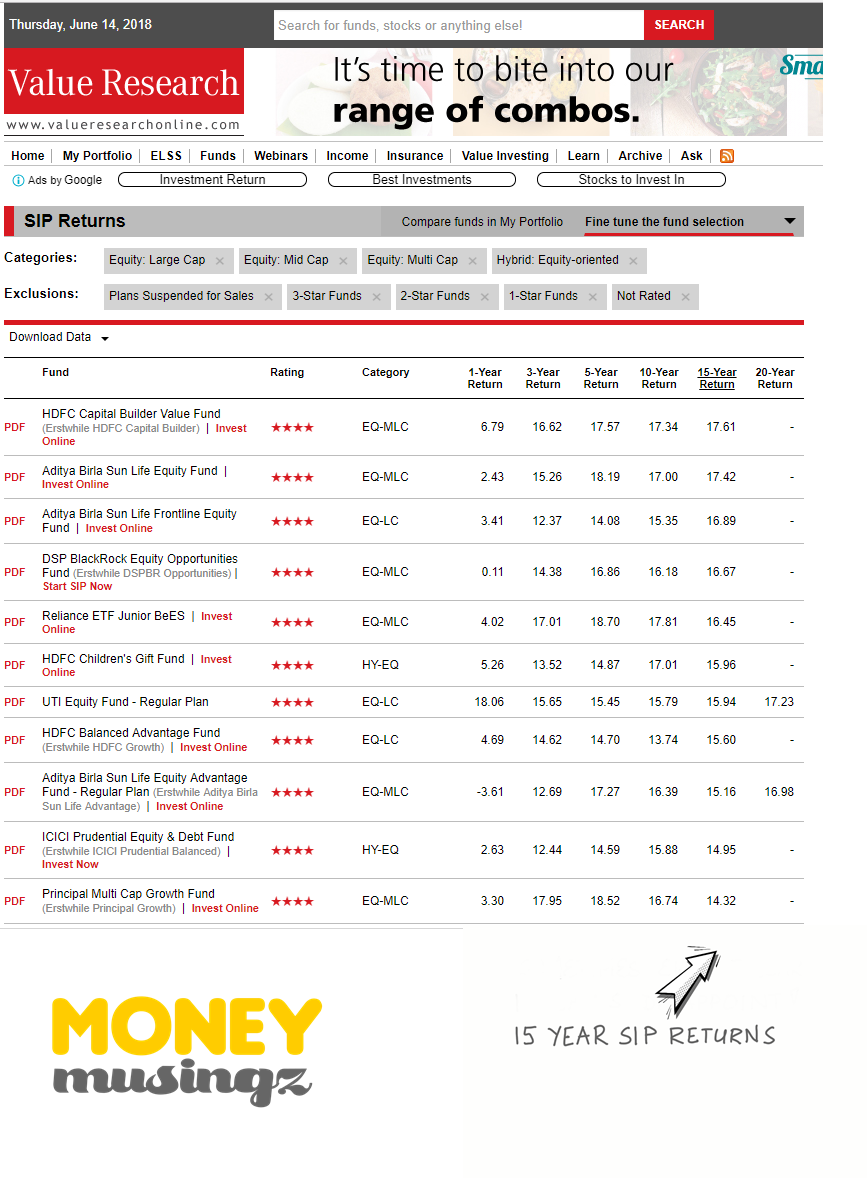

Data: valueresearchonline.com

Data: valueresearchonline.com

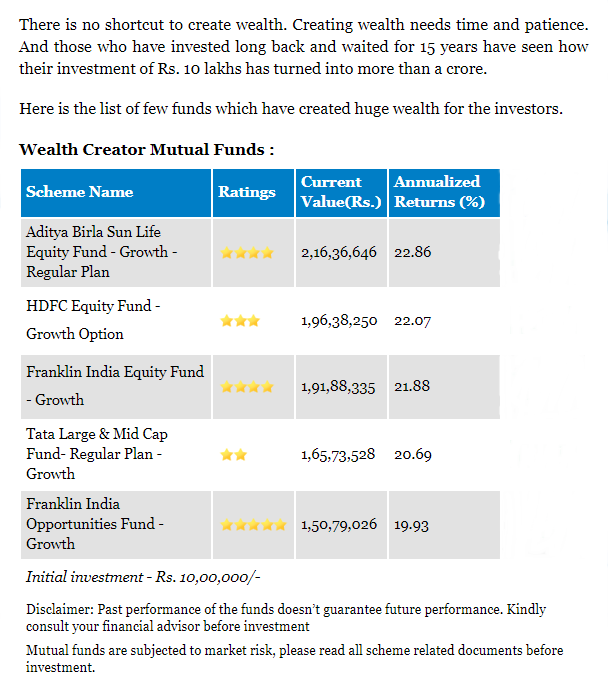

Suppose you had invested Rs.10,00,000 lump sum and held the investment for 15 years:

Data: Karvy Email

The value of investments can fall as well as rise and you could get back less than you invest. If you’re not sure about investing, seek independent advice.