One of the big benefits of demonetization was that it served as a big trigger for Indians to go and put their hard earned money into financial products rather than physical assets.

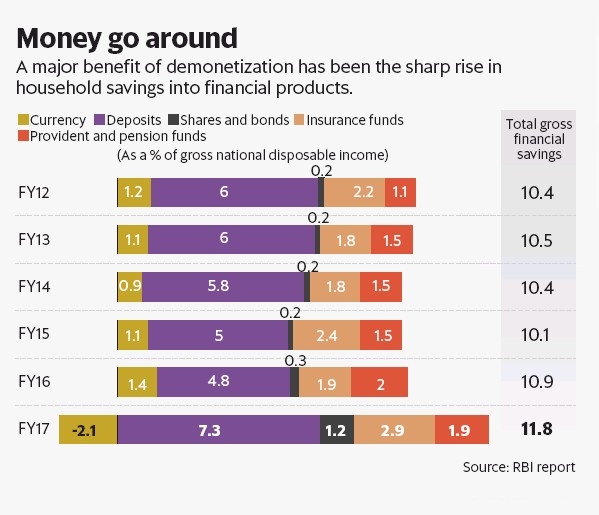

Data from the RBI shows that gross financial savings rose to 11.8% of the gross national disposable income in fiscal year 2017, a notable climb of 90 basis points from 10.9% in the previous year.

Not surprisingly, the improvement into financial savings was led mainly by bank deposits. After all, Indians were given 50 days to deposit their invalid cash into their bank accounts. And that is exactly what the people were preoccupied with during the demonetization months.

So, savings into bank deposits surged 7.3% of GNDI in FY17 from 4.8% in FY16. Other products also caught a slice or two of financial savings.

Indians invested 1.2% of their disposable income into shares and bonds, a massive improvement from the average 0.2% in the years before. A look at how stock indices have soared since demonetization should be enough to add a sense of certainty to this. The inflows into equity mutual fund schemes are another indicator of how the stock market gained from getting a bigger slice of household savings. The insurance sector also benefited, with 2.9% of disposable income flowing into it.

But before we rejoice, a look at household debt is warranted. Household debt rose to 3.7% of GNDI from 3.1%, which means Indians resorted to loans after being bereft of cash. Adjusted for this, net financial savings come to 8.1% of GNDI, while that into physical assets is still higher at 10.7%.

True, savings deployed into physical assets have fallen but to shrug off a behaviour passed down through generations is difficult. There is no doubt demonetization caused a sea change into how people invest. But like always, the bigger question is will this sustain?

RBI has made good the loss of 86% of cash by rapid remonetization and that too with a higher denomination note of Rs.2,000. Whether Indians revert to their tried-and-tested investments in gold and real estate or whether they will retain and increase the proportion of their savings in financial assets will be disclosed only in the years to come.