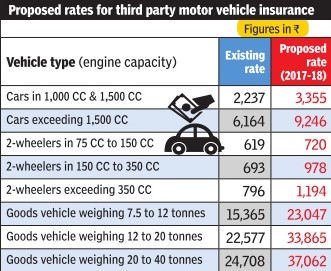

From April, vehicle owners will have to pay more for the third-party motor insurance premium. While there will be no increase in premium for private cars with engine capacities below 1,000 cc, those above 1,000 cc will cost around 50% more. The hike for two-wheelers would be in the range of 16 to 50% and for commercial vehicles up to 50%.

The proposed hike by the Insurance Regulatory and Development Authority of India will be the sharpest in recent years. In fact, the regulator has revised the mandatory-cover rate every year for the past six years.

Motor insurance comprises own-damage and third-party insurance. Any vehicle that plies on the road needs a third-party cover under the Motor Vehicles Act and insurers will have to ensure that the policy is available at their every underwriting office. To arrive at the new third-party motor premium in April, the regulator has analysed the data supplied by the Insurance Information Bureau of India for accident years from 2011-12 to 2015-16 for gross premiums and claims paid. The ultimate claim costs for each underwriting year are estimated using Chain Ladder Method applied on cumulative paid claims data. Based on these parameters, the regulator had put in place a formula in 2011 to calculate the pricing annually.