Infosys was established by NR Narayana Murthy and six engineers in Pune with an initial capital of $250. It made an initial public offer in February 1993 and its shares were listed on Indian stock exchanges on June 14, 1993.

Trading opened with a huge premium of Rs.145 per share, compared to its issue price of Rs.95 per share. In March 1999, it issued 20,70,000 American depository shares (equivalent to 10,35,000 equity shares of par value Rs.10 each) at $34 per ADS. The same was listed on the NASDAQ National Market.

Since then, Infosys hasn’t looked back. From an initial capital of $250, it has grown to become a $10.9 billion (FY 18 revenue) company with a market capitalisation of about $40 billion. The IT bellwether and its subsidiaries had 204,107 employees as on March 31.

Back of the envelope calculations suggests that if one had invested Rs.10,000 or bought nearly 100 shares of Infosys back in 1993, it would be worth over Rs.2 crore as on June 12.

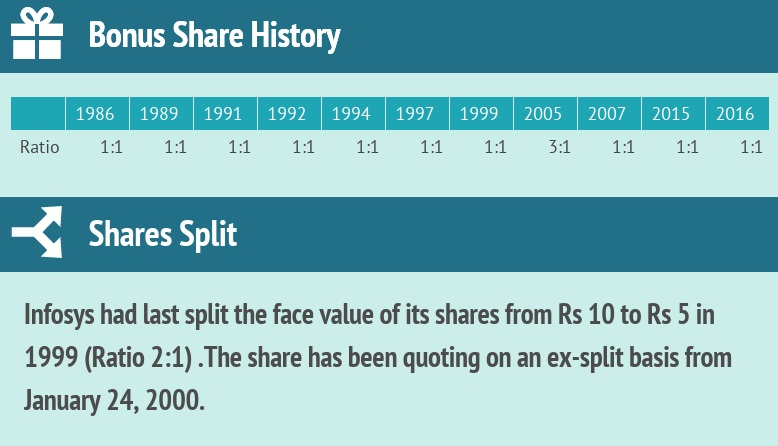

The management has been generous in granting bonus since its listing. It has offered 1:1 bonus shares in 10 out of 11 years when it declared a bonus issue. In 2005, it announced a 3:1 bonus issue.

It had split the face value of its shares from Rs.10 to Rs.5 in 1999 (2:1). The share has been quoting on an ex-split basis since January 24, 2000.

If we take into account the bonus and stock splits, then value of the investment would have grown to Rs.2.1 crore, a compounded annual growth rate of 36.20 percent. Number of shares after adjusting for bonus would have risen from 100 to 17,064.

Explaining the rationale:

• In 1994, company declared 1:1 bonus = Investor receives 200 shares

• In 1997, company declared 1:1 bonus = Investor receives 400 shares

• In 1999, company declared 1:1 bonus = Investor receives 800 shares

• In 1999, company split the share of face value Rs.10 to Rs.5 = Investor receives 1,600 shares

• In 2004, company declared 3:1 bonus = Investor receives 6,400 shares

• In 2006, company declared 1:1 bonus = Investor receives 12,800 shares

• In 2014, company declared 1:1 bonus = Investor receives 25,600 shares

• In 2015, company declared 1:1 bonus = Investor receives 51,200 shares

Total worth = Total number of shares 51,200 x 1,258 (close as on June 12) = Rs.6,44,09,600 (Rs.6.44 crore), indicating a CAGR of 44.42% percent.

If you want to become a Crorepati by investing in stock market than invest in fundamentally strong companies for long term. Don’t pull out your investments in the down market but add more stocks into your portfolio at cheaper price whenever the market goes down….. Hold your stocks for 1 or 2 decades. The reason for holding stocks for this much long is very scientific and logical. Any business takes time to grow and it requires a full business cycle (7-10 years) to unlock the value of business. So more the Business cycles you allow to pass on, the more value unlocking of your stock and thus more profit to you………….