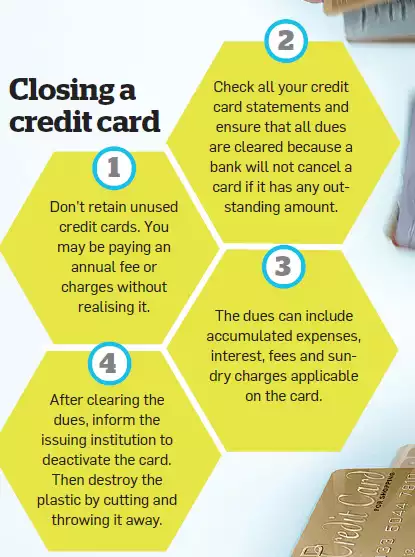

There comes a time when you might feel that you no longer needs a credit card, or that you don’t want one anymore. Sometimes, people forget to use their card and rely mostly on debit cards and cash. In other cases, a customer may switch to a better credit card and forget to close the old one. According to industry experts, it is important to close or cancel the credit card as soon as possible. This will ensure the customer does not rack up unnecessary charges.

You need to first inform the bank that you want to discontinue the service and request for cancellation. You can do it online, over a phone call or email. You have to provide details such as credit card number, reason for cancellation, location, contact number and email ID.

Once you have informed the bank, a bank executive will connect with you. Some banks may take three working days to confirm your request. Once your request is confirmed, the process of cancellation will be initiated, which will take at least seven working days

In case you have outstanding dues on your credit card, you will have to clear it based on the latest statement the card-issuing company will send. The bank may also ask you to send the physical credit card cut into four pieces for cancelling the card.

Only after you get a communication from your card-issuer that your credit card has been cancelled is the process complete. Hence, check for correspondence from the bank.