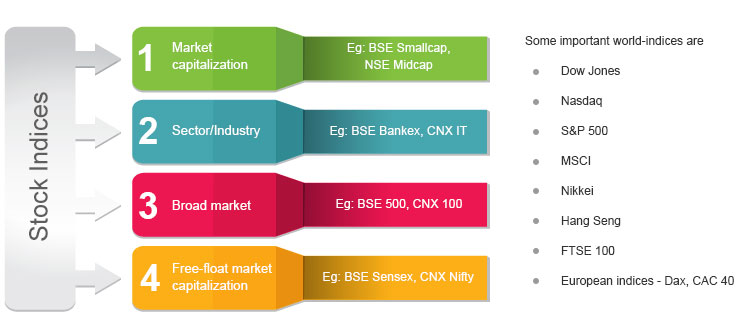

Market capitalisation is the out standing number of shares of a company multiplied by its current market price.For example, if a company has 1 lakh outstanding shares and the stock price is Rs.30, then the market capitalization of the company is Rs.30 lakh.

In free float market capitalisation, the value of the company is calculated by excluding shares held by the promoters. These excluded shares are the free float shares.For example if a company has issued 10 lakh shares of face value Rs.10, but of these, four lakh shares is owned by promoter, then the free float market capitalisation is Rs.60 lakh.

Free float market capitalisation is lower than total market capitalisation as shares held by promoters or those that are locked in are excluded.

Stocks that have small free float are likely to see higher price volatility as it takes fewer trades to move the share price. On the other hand, in the case of a larger free float, volatility is lower. In stocks with a large free float, the number of people buying and selling the shares is higher and so, a small amount of trading does not affect the price significantly.

Both NSE and the BSE use the free float market capitalisation method to calculate their benchmark indices Nifty and Sensex respectively, and assigning weight to stocks in the index. So a company with a higher free float has a higher weightage on the indices. A free float index reflects market trends better as it takes into consideration only those shares which are available for trading. It also makes the index more broad-based as it helps to reduce the concentration of top few companies.