The Reserve Bank of India has now made it mandatory for all credit information agencies to provide a full credit report without a charge, on request, once a calendar year to individuals whose credit history is available. This has come into force from 1 January 2017.

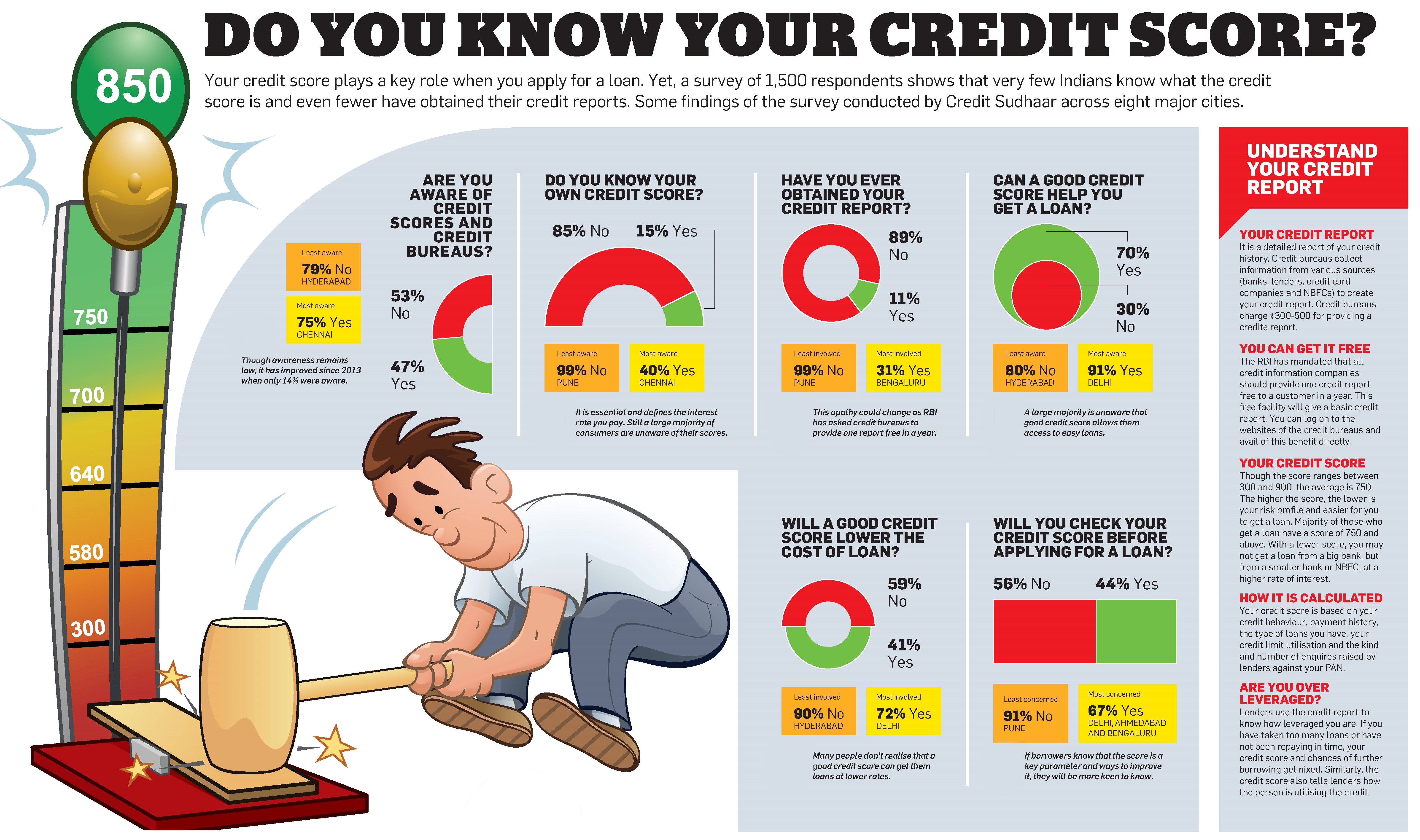

A credit information report contains details of your credit history collated by a credit information company. At present, there are four such companies in India: Credit Information Bureau (India) Ltd (Cibil), Equifax Credit Information Services Pvt. Ltd, Experian Credit Information Co. of India Pvt. Ltd and CRIF High Mark Credit Information Services Pvt. Ltd.

Whenever you apply for a loan, the lender asks a credit bureau for your credit background to check if you have paid earlier dues on time. The information shows your monthly payments and how you manage your credit. This forms a part of your overall credit history and will reflect in your CIR.

A CIR also helps individuals to check their own eligibility for a loan. A score is assigned based on the information. According to Cibil, 79% of loans approved are for individuals with a score higher than 750 (the range is 300-900).

To get details of your credit history, you generally have to buy this report. At present, you can get a report along with a credit score once a year for Rs.400-550. To buy a report online, you have to share details such as date of birth, Permanent Account Number and email address. However, you will now be able to access one detailed report in the electronic form, without being charged for it, once a year.

This will contain all the details that a bank will get as part of a similar report, if you were to request for a fresh loan. The report will show the latest position of loan(s) that you may have with one or more lenders. You can also rectify any errors that may be in a report, through a dispute resolution process.

The central bank has asked credit rating companies to put the process of accessing a free report on their respective websites, which the companies have done.

The credit report will have your account information, which has details of monthly payments for at least 36 months, names of banks from where you have loans, and the type of loan (home, auto, personal loan and credit cards). It also gives the status of outstanding loans.

Then there is an enquiry section that shows details of banks that have viewed your report to assess a loan application, the date when you enquired about your report, type of loan (secured or unsecured) and the amount.

Late payments indicate that you are unable to service existing obligations. Avoid delayed payments and defaults.

You should also restrict enquiries for new loans if you are already leveraged, as it indicates you are planning to take greater credit risk, and this reflects negatively on your credit history.

This Chart had been published in ET Wealth.