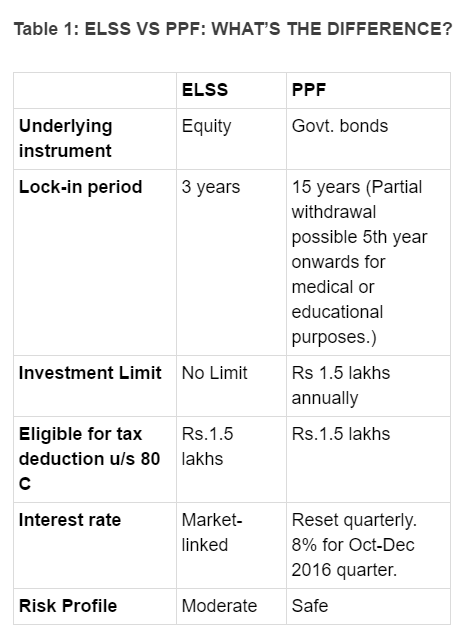

Public Provident Fund and Equity Linked Savings Schemes are two of the most popular avenues when it comes to tax savings under Section 80C. And so, despite being quite different, they are often compared to each other.

ELSS is a pure equity-based investment while PPF invests in government bonds. As a result ELSS funds give you much higher returns but, like any equity oriented instrument, can be volatile. PPF, on the other hand, is extremely safe, gives you assured but much lower returns.

For a lot of people, PPF has been the go to tax-saving investment given its risk averse, fixed interest nature. Whether the safety element of a PPF is worth the low returns and extremely long lock in period? Even the ELSS fund with the lowest returns in the category has given more than 13% returns in a five-year period and average returns over a three & five-year period have been more than 17%.

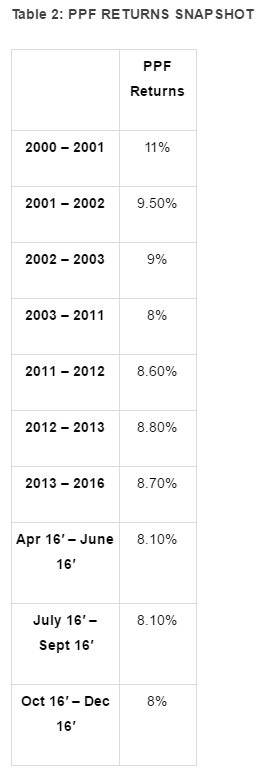

On the other hand, interest rates in India have been trending downwards for some time now and returns of small savings schemes like the PPF have also come off from their highs. For the ongoing quarter, PPF interest rate is at 8%, and is only expected to fall further going ahead.

Another key thing to consider is the liquidity aspect of your investment. While the lock-in period of ELSS is 3 years, PPF locks in your investment for 15 years. You can make a partial withdrawal after the investment completes 5 years, but only if you prove that the money is needed for a medical emergency or for higher education.

It’s very important to remember that the volatility of equity investments significantly reduces, the longer you hold on to them. So if your time horizon is more than 3 years, then ELSS funds is a better choice. Ideally, remain invested in ELSS funds for at least 5 years.

If you’re extremely risk averse, then you could look at splitting your corpus between ELSS & PPF. The PPF investment will ensure your capital remains protected and the ELSS investment will provide an additional boost in your overall returns.

The popularity of ELSS is soaring among investors. In the first eight months of the current financial year, this product category has mobilised Rs.4,121 crore as compared to Rs.2,367 crore during the same period in the previous year. Financial advisors said superior returns in the past, lowest lock-in period and falling interest rates are prompting investors to look at ELSS.

These schemes delivered 17% and 16% over a 5-and 10-year period respectively , which is higher than fixed income investments in the tax saving category .

Since Hindu Undivided Family (HUF) cannot open fresh PPF accounts and have to compulsorily withdraw money after completion of 15 years, this money is flowing into ELSS schemes.